Financial Planning for Retirement

Whether you’re just beginning your retirement journey or are already enjoying your golden years, here’s a comprehensive guide to help you navigate the complexities of financial planning for retirement.

Budgeting

Creating a realistic budget is the cornerstone of financial planning for retirement. Start by evaluating your current expenses and income streams. Identify areas where you can cut back without sacrificing your quality of life. Consider factors such as housing, healthcare, transportation, entertainment, and travel. Allocating funds for emergencies and unexpected expenses is also crucial. Regularly review and adjust your budget as your circumstances change.

Saving

It’s never too late to start saving for retirement, but the earlier you begin, the better. Maximize contributions to retirement accounts such as 401(k)s, IRAs, and Roth IRAs. Take advantage of employer matching contributions whenever possible. Explore additional savings vehicles, such as health savings accounts (HSAs) and taxable investment accounts. Set specific savings goals and automate contributions to ensure consistent progress toward achieving them.

Investing

A well-diversified investment portfolio can help you grow your retirement savings while managing risk. Consider your risk tolerance, time horizon, and financial goals when crafting your investment strategy. Asset allocation is key—spread your investments across different asset classes, such as stocks, bonds, real estate, and alternative investments. Regularly rebalance your portfolio to maintain your desired risk-return profile. Consult with a financial advisor to develop a personalized investment plan tailored to your needs and objectives.

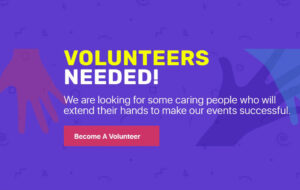

Be Someone’s Hero

Volunteer

Making the Most of Retirement Funds

Maximizing the value of your retirement funds requires careful planning and strategic decision-making. Delaying Social Security benefits can result in higher monthly payments later in life. Explore options for generating supplemental income, such as part-time work, freelancing, or monetizing hobbies and skills. Be mindful of tax implications when withdrawing funds from retirement accounts—consider strategies such as Roth conversions and tax-efficient withdrawal strategies to minimize taxes in retirement.

Continual Monitoring and Adjustment

Financial planning for retirement is not a one-time task but an ongoing process. Regularly monitor your financial situation and adjust your plan as needed. Stay informed about changes in tax laws, investment markets, and healthcare costs that may impact your retirement outlook. Periodically revisit your goals, risk tolerance, and asset allocation to ensure they remain aligned with your evolving needs and circumstances.

Effective financial planning is the key to enjoying a secure and fulfilling retirement. By budgeting wisely, saving diligently, investing prudently, and making the most of your retirement funds, you can create a solid financial foundation for the years ahead. Stay proactive, stay informed, and seek professional guidance when needed to optimize your retirement journey. With careful planning and strategic decision-making, you can embark on this new chapter with confidence and peace of mind.

2wok84